ZOPA is a pioneer in social lending. You might have heard about it as a peer-to-peer lending and I am fascinated by this idea!

It's quite simple: financial transactions take place between the individuals without any intermediate financial institutions. And Zopa is a marketplace where people can lend anything from £10 to upwards of £25,000

It's quite simple: financial transactions take place between the individuals without any intermediate financial institutions. And Zopa is a marketplace where people can lend anything from £10 to upwards of £25,000

Lending and borrowing from person to person like it was done hundred of years ago... But apart from its nostalgic value social lending has a lot of benefits for the participating individuals.

For the lender this means interest rates way above offers of current saving accounts and alike; for the borrower - loans are being made available to a much more lower rate as offered through banks and building societies.

As a lender you choose the rate, risk level and time period you wish to lend your money for. You transfer the money into ZOPA account (a segregated RBS account, meaning that it does not form part of Zopa's assets) from where your money gets lent out. The borrower checks current lending rates, applies for a loan in a way very similar to the one used by banks. Loan is "reserved" for the borrower until the final credit checks are being performed. And if everything goes well money is paid into the borrowers' account within several days.

As a lender you choose the rate, risk level and time period you wish to lend your money for. You transfer the money into ZOPA account (a segregated RBS account, meaning that it does not form part of Zopa's assets) from where your money gets lent out. The borrower checks current lending rates, applies for a loan in a way very similar to the one used by banks. Loan is "reserved" for the borrower until the final credit checks are being performed. And if everything goes well money is paid into the borrowers' account within several days.

ZOPA operates in UK, it was operating in the US but has scaled the operations down due to regulatory difficulties facing by all peer-to-peer providers there.

It now expands to Japan and Italy (a bit of a weird choice in my opinion, but here we go). In UK ZOPA got a lot of positive press coverage ranging from BBC to Money Talk by Fool.co.uk.

How does it work?

It works a little bit like an online auction.Borrows register, get assessed and put out a request for a loan. They declare what the loan is for, how long for they want to borrow money and how much interest they want to pay for it. Everyone who wants to borrow at Zopa is identity-checked, credit-checked and risk-assessed. Zopa works with Equifax (one of the credit rating agencies) to work out three separate scores that should help lenders make an informed choice when they choose the borrowers.

At the same time lenders decide what type of borrowers they are prepared to lend money: credit rating, term, etc. Once a listing becomes 100% funded, you can see that the overall interest rate will begin to fall as lenders compete with each other to be included in the loan.

At the same time lenders decide what type of borrowers they are prepared to lend money: credit rating, term, etc. Once a listing becomes 100% funded, you can see that the overall interest rate will begin to fall as lenders compete with each other to be included in the loan.For example: a pensioner is asking for £2000 to clear overdraft. He wants the loan for 24 months and would like to pay 7.9% in interest. His request got 100% funding and you can see how the overall interest rate has dropped even below his request to be 7.3% four hours before the end of this "auction".

As a lender you don't have to offer the full amount asked. In the example above there were 262 lenders offering amounts anywhere between £10 and £500. Offering smaller amounts helps spreading the risk of bad debt. As with the banks there still will be borrowers unable to pay the loan back and as it is with the banks hedging your bets is the key. Hence Zopa would always suggest you spread your money between many borrowers. So when you lend £500 your money gets spread between 10 people.

Zopa works with a collections agency that chases any missed payments on the lender's behalf. This is the same process that banks and other financial institutions use.

Zopa works with a collections agency that chases any missed payments on the lender's behalf. This is the same process that banks and other financial institutions use.

What Can You Earn?

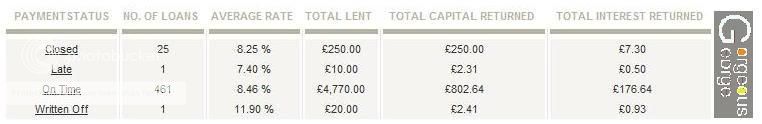

At the moment the average rate enjoyed by lenders on money lent over the last 12 months(after fees and before bad debt) is about 7.9% with 11.7% being the interest rate offered to young people (under 25) for 60 months loans. Lenders pay an annual equivalent 1% fee on the amount they lend to borrowers. A lender lending £1,000 at 7% would earn £70 of interest each year if the money is always lent out and paid back. They would pay a fee of 1%, or £10, in total.Now, you may think a lot of the positive press and a nicely done web site does not mean that it all works. Zopa has a user forum so I had a look around to see if people are complaining. They don't. Some of the lenders have posted their lending books to discuss their success as well as some set backs from defaulted loans.

Looks quite good, doesn't it? I feel soooo tempted to give it a go!!!

Would you? It's a bit of a strange feeling just to give your money to other people even though it's all regulated and kind of secure ... And even though I am a bit wary I also find the idea so cool ... I don't know... I can't decide if I should try it or not... It makes sense to invest at least £500 to hedge the risk of bad debt and the money would be not really available if I needed it as the loans are given out for at least 12 months ...

What would you do? Should I do it?

Get smarter with your money, get updates straight to YOUR EMAIL or RSS Feed now!

1 comments:

That second loan book is mine and I wholeheartedly recommend you give it a try. Since that snapshot was taken, my late payer is back on time and I have over 600 loans that are 'on time'.

http://uk.zopa.com/member/GE0RGE

GG

Post a Comment